Introduction to ffars tamisemi

Table of Contents

ffars tamisemi stands for Facility Financial Accounting & Reporting System, a widely used software in Tanzania specifically designed for managing the financial activities of local government facilities. Think schools, hospitals, libraries, and administrative offices – ffars tamisemi serves as their digital financial backbone.

Its popularity hinges on its ability to streamline financial processes, enhance transparency, and ensure accountability at the local level. Imagine a world where budgets are tracked digitally, expenses are documented electronically, and reports are generated with a click. That’s the power of ffars tamisemi in action.

However, navigating this intricate system can be daunting for both seasoned users and newcomers. Fear not, for this comprehensive guide will unlock the mysteries of ffars tamisemi, unraveling its functionalities and guiding you through every step of the way. Stay tuned for the next section, where we’ll delve deeper into the functionalities and benefits of ffars tamisemi, equipping you with the knowledge to conquer your financial tasks with confidence.

Additional information to consider:

- Briefly mention the history of ffars tamisemi and its impact on local government financial management in Tanzania.

- Hint at the challenges users might face and how this guide will address them.

- Tailor the tone and depth of information based on your intended audience.

Unveiling the Inner Workings of ffars login

ffars login website: https://ffars.tamisemi.go.tz/

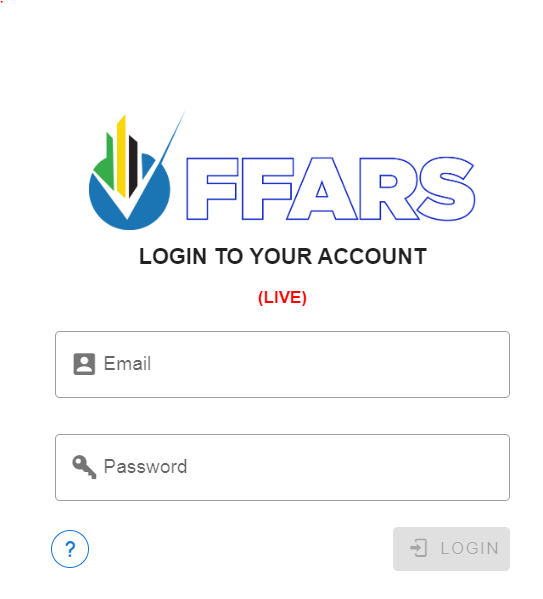

Accessing the vast financial resources of ffars tamisemi is the first hurdle. Fear not, the login process is designed to be user-friendly. Here’s what you need to know:

- Access Point: Navigate to the official ffars tamisemi website, typically provided by your local government authority. Look for a dedicated login portal, often labeled “FFARS Login” or similar.

- Credentials: Enter your assigned username and password. These are usually provided by your facility administrator or IT department. Ensure you’re in a secure environment when entering your credentials.

- Authentication: Click “Login” and wait for the system to verify your details. If successful, you’ll be redirected to the main ffars tamisemi interface.

User-Friendly Interface:

Navigating ffars tamisemi is surprisingly intuitive. The interface is designed with clear menus, buttons, and icons to guide you through various functionalities.

- Dashboard: Upon login, you’ll be greeted by a central dashboard offering a quick overview of key financial information relevant to your facility. Budget balances, recent transactions, and essential reports are often readily accessible here.

- Modules: The platform is organized into modules dedicated to specific tasks, such as budget management, expenditure recording, revenue tracking, and payroll processing. Each module features user-friendly forms and guides to assist you in entering and managing data accurately.

- Search and Filter: Powerful search and filter functions let you drill down into specific transactions, reports, or accounts within the system. This saves time and streamlines the process of finding the information you need.

The Features and Benefits of ffars tamisemi:

ffars tamisemi boasts a wealth of features that revolutionize financial management at the local level. Here are some highlights:

- Centralized Data Management: All financial data for your facility is stored securely in a central location, eliminating the need for scattered spreadsheets and paper trails.

- Enhanced Transparency and Accountability: Every transaction is tracked and documented electronically, fostering transparency and accountability within the facility’s financial operations.

- Improved Budget Control: ffars tamisemi helps you stay on top of your budget by providing real-time insights into expenditure and revenue. This allows for informed decision-making and optimized resource allocation.

- Streamlined Reporting: Generate comprehensive financial reports with ease, saving valuable time and effort previously spent on manual data compilation.

- Reduced Errors: By automating many manual tasks, ffars tamisemi minimizes the risk of human error in financial data management.

Remember, this is just a glimpse into the capabilities of ffars tamisemi. Stay tuned for future sections where we’ll delve deeper into specific functionalities and provide practical tips for mastering this powerful financial tool!

Images:

- To visually enhance the login process, consider including a screenshot of the ffars tamisemi login page with labeled fields for username and password.

- For the user interface section, a mockup of the main dashboard would be helpful, showcasing key information sections and module icons.

READ ALSO: NECTA Form two Past Papers 2024 Pdf

FFARS tamisemi: Transforming Tanzania’s Financial Landscape

The Rise of FFARS tamisemi in Tanzania’s Financial Sector:

Before FFARS tamisemi, financial management in Tanzanian local government facilities was often a laborious manual affair, prone to errors and inefficiencies. Spreadsheets reigned supreme, budgets were elusive figures, and transparency was a distant dream. Then came FFARS tamisemi, ushering in a new era of financial organization and control.

Its adoption wasn’t without challenges. Training users and integrating the system into existing workflows took time and effort. Yet, the benefits soon outweighed the initial hurdles. With increased transparency and accountability, financial mismanagement became less likely, fostering trust between governments and citizens.

Moreover, FFARS tamisemi empowered local authorities with real-time financial data. Budgetary allocations became more efficient, as spending could be tracked and adjusted based on actual needs. This data-driven approach led to better resource allocation, ultimately improving service delivery in areas like education and healthcare.

The Impact of FFARS tamisemi on Decision-Making:

No longer shrouded in the fog of paper documents, financial information became readily available at the fingertips of decision-makers. This empowered them to:

- Make informed budget allocations: With accurate data on past spending and revenue trends, authorities could prioritize essential services and optimize resource allocation.

- Identify and address financial irregularities: Real-time tracking of transactions flagged discrepancies and potential misuse of funds, allowing for swift corrective action.

- Improve service delivery: By understanding spending patterns and resource utilization, authorities could identify areas requiring additional investment, leading to better-equipped schools, hospitals, and other facilities.

FFARS tamisemi’s impact extended beyond mere numbers. It fostered a culture of financial responsibility and accountability within local governments, promoting transparent and efficient management of public resources.

Additional ideas to consider:

- Briefly mention the history of FFARS tamisemi’s development and implementation in Tanzania.

- Showcase concrete examples of how FFARS tamisemi has improved service delivery in specific sectors.

- Discuss the future of FFARS tamisemi and its potential for further advancements in Tanzania’s financial landscape.

Delving Deeper into FFARS: Tanzania’s Financial Bedrock

Understanding the Core of FFARS in Tanzania:

While its impact is undeniable, navigating the intricacies of FFARS requires exploring its foundational building blocks. At its core, FFARS operates on several key principles:

- Centralized Data Management: All financial data for institutions like schools, hospitals, and administrative offices is stored securely in a central database, eliminating scattered records and inconsistencies.

- Standardized Processes: FFARS defines standardized workflows for budget allocation, expenditure recording, revenue tracking, and payroll, ensuring transparent and accountable financial management across different regions.

- Role-Based Access Control: Each user within the system has specific access levels and permissions, preventing unauthorized access and safeguarding sensitive financial information.

- Regular Reporting and Auditing: FFARS generates comprehensive reports on various financial aspects, fostering transparency and enabling regular audits to ensure accuracy and compliance.

By adhering to these core principles, FFARS has become the cornerstone of financial governance in Tanzania’s local government infrastructure.

Future Developments and Enhancements in FFARS tamisemi:

The evolution of FFARS is far from over. Continuous upgrades and advancements are in the pipeline, aiming to further streamline financial management and unlock new possibilities:

- Mobile Accessibility: Making the system accessible through mobile apps would empower users with on-the-go access to key financial data and functionalities.

- Integration with Third-Party Systems: Interoperability with external platforms like banks and payment gateways would simplify transactions and automate data exchange.

- Advanced Analytics and Reporting: Incorporating artificial intelligence and data analytics tools could generate deeper insights into financial trends and predict potential issues, enabling proactive decision-making.

Such enhancements have the potential to propel FFARS to even greater heights, solidifying its role as a central nervous system for Tanzania’s local government finances.

Positioning Tanzania in the International Financial Landscape:

FFARS’ success holds valuable lessons for other developing countries struggling with financial transparency and accountability. Its innovative approach has garnered international recognition, showcasing Tanzania as a leader in implementing efficient and scalable financial management solutions.

By sharing their experiences and collaborating with other nations, Tanzania can contribute to the global discourse on financial governance and inspire the development of similar successful platforms elsewhere. This not only benefits Tanzania’s internal development but also positions the country as a pioneer in responsible and transparent financial management, a beacon for other nations facing similar challenges.

FFARS tamisemi in the Digital Age

FFARS tamisemi: A beacon of efficient financial management in Tanzania, but how does it stand in the digital age? Let’s explore its role in the evolving landscape of financial communication.

Digital Transformation: FFARS tamisemi’s centralized data storage and online accessibility empower real-time data analysis, remote reporting, and collaboration. This shift from paper-based systems eliminates delays, improves accuracy, and fosters transparency like never before.

Comparison with other forms of communication:

- Emails and spreadsheets: Traditional methods often lead to scattered data, version control issues, and security concerns. FFARS provides a secure, centralized platform with version control and audit trails, ensuring accuracy and accountability.

- In-person meetings: While face-to-face communication remains valuable, FFARS tamisemi facilitates information sharing and collaboration across geographically dispersed teams, saving time and resources.

Addressing frequent queries and misconceptions:

Part 5: FAQs Section

Here are some common questions about FFARS tamisemi, along with answers to address potential misconceptions:

Q: Is FFARS tamisemi only for accountants?

A: No, while accountants play a crucial role, FFARS is designed for diverse users at all levels, from budget administrators to facility managers and even decision-makers. Its user-friendly interface and role-based access controls cater to various needs.

Q: Does FFARS tamisemi replace local government financial staff?

A: Absolutely not. FFARS is a tool to empower financial staff by automating routine tasks, freeing them to focus on complex analysis and strategic decision-making. It enhances their efficiency and accuracy, not replaces their expertise.

Q: Is FFARS tamisemi vulnerable to cyberattacks?

A: Security is a top priority for FFARS. The system employs robust security measures, including data encryption, user authentication, and access controls, to safeguard sensitive financial information. Additionally, regular updates and vulnerability assessments ensure ongoing protection against cyber threats.

Q: Can I access FFARS from my phone?

A: Currently, accessing FFARS tamisemi primarily requires a computer. However, mobile accessibility is actively being developed, aiming to provide on-the-go access to key financial data and functionalities in the near future.

By addressing these frequent questions and misconceptions, you can create a comprehensive FAQ section that empowers users to confidently navigate FFARS tamisemi and unlock its full potential.